Why Solar City has a date with destiny.

Point 1:

Basically: Solar City is deceiving investors.

“Stated differently, you can run a company that burns $100s of millions of dollars in cash, yet take on massive amount of debt/leverage, and include this in your definition of free-cash-flow, and Abracadabra you’re a good business. At best this is financial illusion, and at worst outright deception (i.e., trying to get investors to accept a new definition for free-cash-flow). I guess, in this world where central bankers are solving massive leverage problems with even more leverage, perhaps SolarCity feels no one will call them out for this. But, I think it’s a very important dynamic to focus on as the narrative the company is telling people is built on an assumption of free-cash-flow which, at its core, is based on an improper definition.”

Point 2:

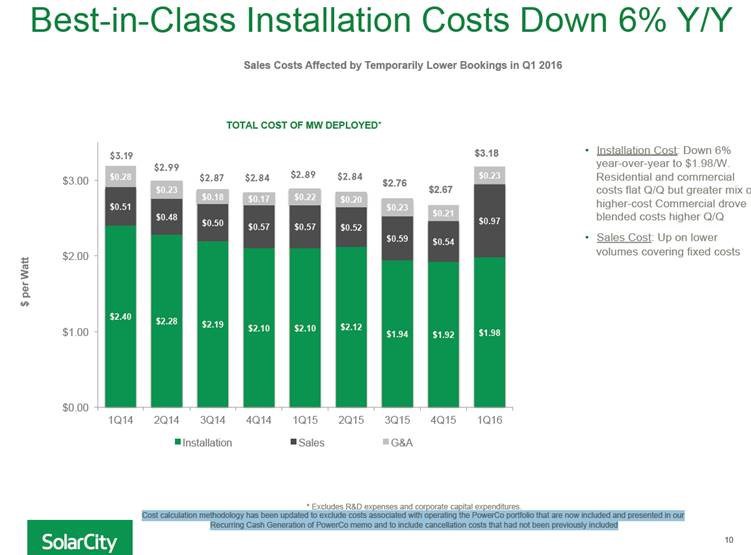

Basically: SolarCity keeps on changing the way they calculate cost.

“[SolarCity] has restated the way it calculates its cost/watt (i.e., the key metric that derives their costs); and, in each quarter they’ve restated, their newly reported costs are lower. Their specific verbiage, as detailed below, is: “cost calculation methodology has been updated to exclude costs associated with operating the PowerCo portfolio that are now included and presented in our Recurring Cash Generation of PowerCo memo and to include cancellation costs that had not been previously included”.”

Point 3:

Basically: The renewal deals are not forward looking. You rent a solar panel that will get outdated.

“A lot of people want to give SolarCity value for renewals in their portfolio While we are assuming a value for SCTY’s “renewal portfolio”, which, again, assumes 20yrs into the future, 100% of the SCTY customers with SCTY systems on their roof will opt to renew the contracts with SCTY at prices that will be above the prices of technology 20yrs into the future; stated differently, it’s the equivalent of assuming you will buy a computer from 1996 today for more than you would pay for a 2016 model? Probably not… thus, in reality the renewal value is not worth much, if anything – it’s an option.”

Point 4:

Basically: who will be paying this debt? American taxpayers through 4.9 billion in subsidies.

“They had talked about a 4.5% blended cost of debt 4 months ago – rates have barely moved – and now, their capital costs are much, much higher at about 8.23%… if rates go up, then what happens?”

Point 5:

Basically: 2.8 billion in debt that somehow needs to be paid off

“Last year, SolarCity burned over $800mn on 870MW of installs, or $0.92/W; this, or a loss on installations, is not being included in anyone’s cost calculations.

Overall, SolarCity is a company that perpetually burns OCF, FCF, and generates grossly negative EBITDA, with $2.4bn in net debt and business model predicated on perpetual capital issuance/needs (they buy solar systems, then lease them out to you/me over a 20yr period collecting cash over the lifetime of the project [which is why they perpetually burn money – it’s simply an asset vs. liability duration mis-match]).”

* * *

“While we agree that it is only a matter of time SolarCity becomes the next SunEdison, perhaps the real question for this typical Elon Musk construct is not whether the company is the next SunEdison, but whether Tesla will be the next SolarCity…”

Author: Tyler Durden

Sources:

http://www.zerohedge.com/news/2016-05-10/five-reasons-why-pain-solarcity-just-starting

http://www.zerohedge.com/users/tyler-durden