Summary

Tesla has proposed an exchange of shares that at the midpoint equates to paying $27.50/share for SCTY.

The market is telling us this deal is no good. Just how bad is this deal?

We crunch the numbers and show that, even in the most optimistic cash flow scenario for SCTY, Tesla should pay no more than $332 million, or $3/share for SolarCity.

Tesla (NASDAQ:TSLA) ended the week down 12% after proposing to buy SolarCity (NASDAQ:SCTY) for $2.5-$3 billion. SCTY ended the week well below the proposed offer price. The market is telling us this deal is no good. Some in the media called it a “bailout” for SCTY.

Just how bad is this deal? We crunch the numbers and show that, even in the most optimistic cash flow scenario for SCTY, Tesla should pay no more than $332 million, or $3/share for SolarCity, which is 89% below the midpoint of the proposed price range.

Tesla Would Be Acquiring A Highly Unprofitable Company

As noted when we put SolarCity in the Danger Zone in September 2015, the company’s revenue growth masks soaring profit losses.

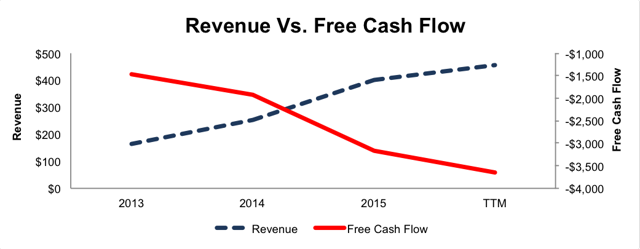

From 2013-2015, SolarCity burned through -$6.5 billion in cumulative free cash flow. Over the last 12 months alone, SCTY’s free cash flow is -$3.6 billion. SolarCity’s revenue has grown from $164 million to $455 million over this same time, per Figure 1.

Figure 1: SolarCity’s Increasing Losses ($ in million)

Sources: New Constructs, LLC and company filings

SCTY’s economic earnings have declined from -$191 million in 2012 to -$1.2 billion over the last 12 months. Much of the losses have been covered by debt, but we think that source of capital may be drying up. The firm’s total debt, which includes off-balance sheet operating leases, has grown from $342 million in 2012 to $4 billion over the last 12 months.

Overpayment Is a Huge Misallocation of Capital

When we put Tesla in the Danger Zone in August 2013, we noted how overvalued the firm was. Now the company is using this overvalued share price as currency to overpay for SolarCity. Tesla has proposed an exchange of shares that at the midpoint equated to paying $27.50/share for SCTY. At $27.50/share, the value of the acquisition would total $7.7 billion ($2.7 billion equity, $5 billion net liabilities) to acquire -$685 million in after-tax profit (NOPAT). The return on invested capital (ROIC) earned on such a deal would equal -9%, well below Tesla’s 9.5% weighted average cost of capital (WACC). To justify paying $27.50/share, Tesla would need, at a minimum, SolarCity’s NOPAT (assuming no capex) to be $731 million or 9.5% of the $7.7 billion purchase price. At that level, the deal would earn Tesla a ROIC equal to its WACC, which is still a low hurdle, but the deal would not destroy value. For reference, the highest NOPAT earned by SolarCity was -$66 million in 2012.

This Deal Makes No Economic Sense for TSLA - A Big Transfer of Wealth to SCTY Investors

To get a sense of how much shareholder value Tesla is destroying, let’s look at some potential scenarios for how much Tesla could improve SolarCity’s business so that it generates some cash flow. First, we account for liabilities that investors may not be aware of that make SCTY more expensive than the accounting numbers would suggest.

- $836 million in minority interests (40% of market cap prior to acquisition announcement)

- $232 million in off-balance-sheet operating leases (11% of market cap prior to acquisition announcement)

- $181 million in outstanding employee stock options (9% of market cap prior to acquisition announcement)

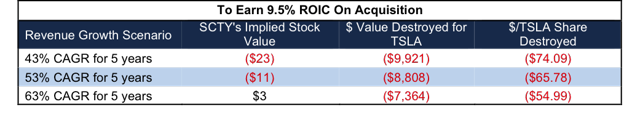

Next, Figures 2 and 3 show the implied stock prices that Tesla should pay for SolarCity to achieve separate “goal ROICs.” Each implied price is based on different levels of revenue growth; 43%, 53% and 63%. These revenue growth rates are equal to or higher than the consensus estimates for 2017 (43%). In each of these scenarios, we conservatively assume that Tesla can grow SolarCity’s revenue and NOPAT without any capital spending beyond the purchase price.

Each scenario also assumes SolarCity immediately achieves 11% NOPAT margins, which is the average of First Solar (NASDAQ:FSLR), NRG Energy (NYSE:NRG), and Canadian Solar (NASDAQ:CSIQ). These competitors are involved in the manufacturing of solar panels, which help boost their margins, and represent a business SCTY is expanding into with the opening of its new manufacturing plant. For reference though, SCTY’s TTM NOPAT margin is -151%.

Figure 2: Implied Acquisition Prices For TSLA To Achieve 9.5% ROIC

Sources: New Constructs, LLC and company filings. $ values in millions except per share amounts. $ value destroyed equals the difference between implied price and midpoint of proposed purchase price plus net liabilities.

The first “goal ROIC” is 9.5%, which is equal to Tesla’s WACC. The big takeaway from Figure 2 is that even if SolarCity grows revenue by 63% compounded annually and achieves 11% NOPAT margins for the next five years, the most Tesla should pay to ensure an ROIC equal to WACC is $3/share, or 88% less than the current market value. We include this scenario as a best case scenario given that consensus estimates peg revenue growth at 47% in 2016 and 43% in 2017. Note that any acquisition that earned a 9.5% ROIC would be value neutral and not create shareholder value.

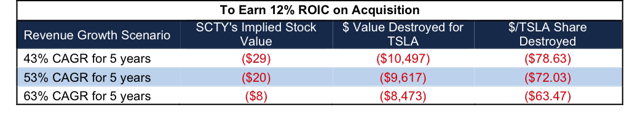

Figure 3: Implied Acquisition Prices For TSLA To Achieve 12% ROIC

Sources: New Constructs, LLC and company filings. $ values in millions except per share amounts. $ value destroyed equals the difference between implied price and midpoint of proposed purchase price plus net liabilities.

The next “goal ROIC” is 12%, which is the average ROIC of traditional auto manufacturers Ford (NYSE:F), General Motors (NYSE:GM), Toyota Motors (NYSE:TM) and Honda (NYSE:HMC). We chose this level of ROIC as a goal to which Tesla could aspire rather than the bottom-quintile -13% ROIC the company scored over the last 12 months. In Figure 3, we see that even in the most optimistic scenario, the implied value of SCTY’s stock price remains negative. The price remains negative because the present value of the future cash flows (even with the 11% profit margins and rocket growth in revenue) remains less than the company’s large liabilities.

The bottom line is that Tesla’s management should have some explaining to do to justify this acquisition at $27.50/share. Why should they pay so much for an unprofitable company?

At the same time, Tesla has operated as a highly unprofitable company for some time with little to no shareholder pushback. Perhaps bailing out Solar City will be the straw that breaks the backs of investors?

The Real Motivation Behind Acquiring SCTY?

Why is Elon Musk doing a deal that, from an economic perspective, looks to destroy so much value for TSLA investors?

When you see the overlap between the executives and board member between the two companies, the conflicts of interest loom large. Tesla purchasing SolarCity for a premium is an easy way to line the pockets of executives of SolarCity, many of who also are Tesla executives, e.g. Elon Musk.

We think it is more than a little unfortunate that Mr. Musk did not make his plans to buy SCTY more prominent during Tesla’s recent $1.4 billion equity sale. Perhaps investors would have been less interested in buying shares in a company that is not only losing money but also paying big premiums for other companies that are losing money. In the same vein, Mr. Musk should have disclosed the fatal crash of a Tesla Model S when it was on auto pilot.

Perhaps, Mr. Musk’s ego is getting the best of him. Major misallocations of capital and withholding of material information from investors do not suggest Mr. Musk has his inventors’ best interests in mind.

Conclusion: Proposed Deal Destroys Shareholder Value

Given the multiple potential conflicts of interests (Elon Musk being the largest shareholder in each company for starters), the completion of this deal is no sure bet. Many board members have already recused themselves from voting on the deal to avoid appearances of any conflict of interests.

Nevertheless, shareholders are not off the hook. The ultimate arbiter for this deal is the market. Investors need to hold management accountable for intelligent capital allocation, or else they can expect companies to continue to destroy shareholder value without feeling any accountability to their investors. Given the analysis above, we think it’s fair to ask both management teams how this deal is fair to their investors. The answer for SCTY investors appears easy. On the other hand, TSLA investors must ask why they should accept such an overpayment for a profitless company.

Author: David Trainer