Being late isn’t the end of the world unless all eyes are on you to deliver. When asked to furnish information related to a fatal accident involving one of its vehicles, Tesla missed that deadline and asked for a one-week extension, despite having a couple months to get this info together.

Read more "Tesla’s late to deliver the one thing it should probably deliver on time"Author: stopelon

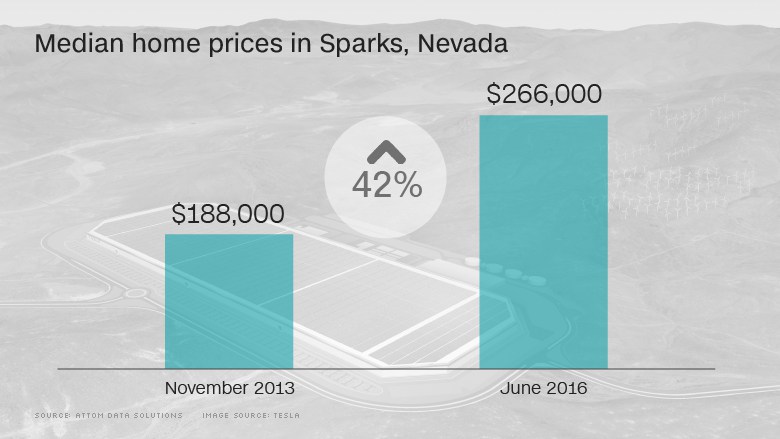

How Tesla caused home prices to soar in this Nevada town

Rapidly rising prices aren’t good for everyone though.

“The potential losers in this situation are folks who live locally and work locally, but aren’t making the higher wages and may not be able to afford the higher prices,” said Blomquist.

Read more "How Tesla caused home prices to soar in this Nevada town"A Tesla Model S Caught Fire During a Test Drive in France

A Tesla Model S caught fire during a test drive in France on Monday.

The vehicle supposedly made a loud noise and sent a warning on the dashboard that there was a problem with charging, Electrek reports. The Tesla TSLA -1.87% employee then told the driver to pull the car over and had all passengers exit the vehicle.

Read more "A Tesla Model S Caught Fire During a Test Drive in France"Tesla And SolarCity: The Sting, Part Deux

Summary

ESG investors are gluttons for punishment: false environmental claims on top of dubious accounting.

SolarCity was ahead on “selling the payments” because their value prop was highly dubious. Maybe Tesla will soon learn.

The new Tesla will be neither an energy company nor green.

Tesla’s Elon Musk Buying Over Half of SolarCity Bond Offer

Musk’s purchase of the so-called “solar bonds” comes after money-losing SolarCity last week said it would cut operating costs to bring expenses in line with its reduced solar installation outlook.

SolarCity CEO Lyndon Rive and Chief Technology Officer Peter Rive are each buying another $17.5 million of the $124 million offer, according to the SolarCity filing.

Read more "Tesla’s Elon Musk Buying Over Half of SolarCity Bond Offer"Don’t Go Against The Family — Musk, Cousins Buy $100 Million In SolarCity

“This is something that we have been thinking about and debated for many years,” Musk, who recused himself from the vote, said in June following the decision.

The move to meld the two companies has all the earmarks of being a family affair.

Read more "Don’t Go Against The Family — Musk, Cousins Buy $100 Million In SolarCity"