The company confirmed the accident on June 30, when the U.S. National Highway Traffic Safety Administration (NHTSA) announced that it will probe the Autopilot system over the accident.

Former SEC chairman Harvey Pitt commented on the situation earlier this week and gave some insights into what the SEC could be looking to investigate and what could be the consequences for Tesla.

Tesla already made its case publicly in a blog post titled ‘Misfortune‘ in which the company explains that it did not believe the accident to be material information at the time of the secondary offering since its engineers had yet to complete their investigation of the accident.

The company later confirmed that it determined the cause of the accident to be the “semi-tractor trailer crossing both lanes of a divided highway in front of an oncoming car” and not the Autopilot. Therefore, they still believe it’s not material to Tesla’s valuation as CEO Elon Musk wrote in an email to Fortune last week.

Harvey Pitt, former SEC chairman, went on CNBC (see interview below) Tuesday, after the Wall Street reported that Tesla was being investigated by the SEC, and claimed that it likely that Tesla broke securities by not disclosing the accident during the stock offering. The former regulator then elaborated on what the SEC could do:

“If it concluded that there’s a violation, it could order that the sale of stocks be rescinded and that Tesla would have to return the money that it received in the secondary offering.”

While it makes sense in theory if the information is indeed found to be material, it makes no sense in practice.

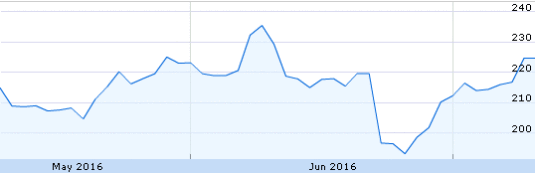

Here’s the stock’s chart from May 7 to July 12:

You might think that the significant drop in June was due to the fatal accident coming to light but no, it’s actually the announcement of the proposed acquisition of SolarCity. The fatal accident is not noticeable on a two month timeframe since the stock actually closed higher than it opened after Tesla confirmed the accident on June 30 after NHTSA announce that it will be probing the Autopilot system.

The shares were sold at the offering for ~$215 per share, while the stock currently trades at over $220. If the SEC forces Tesla to go back to investors and buy back the shares at the price of the offering, it’s unlikely investors will take the deal – at least not with the current market price.

This limits the impact of the investigation based on Pitt’s comment, but the former chairman also added that lawsuits from private investors could follow, but those also normally follow a price drop, which so far is nonexistent.

In his commentary, Pitt then jumped to referencing the claim that Tesla previously itself admitted that an event like the accident in Florida would be material to Tesla in a statement, which the company referred to as “boilerplate”:

“One comment that I found most disturbing is that Elon Musk, when questioned about this, that the disclosure that were made in the registration statement were boilerplate and the SEC has a long history of disliking intensely boilerplate disclosures.”

The statement in question referenced here was called boilerplate by Tesla, not Musk directly, and it was actually not in the registration of the stock offering, but in the company’s quarterly filing (PDF) which coincidently happened between the accident and the stock offering.

As we already explained in our piece ‘Tesla/Elon Musk’s words twisted in attack over material disclosure of fatal Model S Autopilot accident‘, this notion that Tesla admitted to the event being material arose from a series of articles from Fortune. The publication misinterpreted Tesla’s risk disclosure which stated that if a technology was to operate “not as expected” and cause injury or death, it would have a negative impact.

Fortune interpreted the statement by changing the potential of a technology, like the Autopilot, “not working as expected” to simply “involving” the technology, which is simply not the same thing. The tragic accident in Florida certainly involved the Autopilot, in the sense that it was activated during the accident, but that doesn’t mean that the system did not operate as expected since the Autopilot is not meant to prevent that kind of accident.

Despite the clear distinction, Fortune stick with its reporting with the author of the article claiming that it was a security violation. Coincidently (or not), after the claim, the SEC is soon reportedly found to be investigating the situation – though Tesla said that it wasn’t contacted by the commission over the matter.

As the CNBC host discussed after the interview with Pitt, the former chairman even simply suggesting the possibility of the company having to recall the $2.3 billion worth of shares it sold was having a significantly negative impact on the stock as they were speaking. Arguably, it had a bigger impact on the stock than the actual announcement of the fatal accident and the subsequent probe by NHTSA.

Author: Fred Lambert

Twitter: @CFTR

YouTube: Citizens for the Republic

Facebook: @CitizensForTheRepublic

Website: CFTR.org